Chipotle’s Business Model and Performance: Chipotle Stock

Chipotle Mexican Grill, Inc. (CMG) is a popular fast-casual restaurant chain known for its customizable burritos, bowls, tacos, and salads. The company’s success can be attributed to its unique business model, which emphasizes fresh ingredients, customizable menu options, and a commitment to sustainability.

Chipotle’s Business Model

Chipotle’s business model is based on several key elements:

- Fresh Ingredients: Chipotle uses fresh, high-quality ingredients, with a focus on locally sourced produce and naturally raised meats. This approach distinguishes the company from its competitors and appeals to health-conscious consumers.

- Customizable Menu: Customers can personalize their meals by choosing from a variety of ingredients, including proteins, vegetables, salsas, and cheeses. This customizable approach caters to diverse dietary preferences and enhances the customer experience.

- Fast-Casual Dining: Chipotle offers a quick and convenient dining experience, with a focus on efficiency and speed. The company’s streamlined ordering process and self-service model allow customers to quickly assemble their meals.

- Sustainability and Social Responsibility: Chipotle is committed to sustainable practices, including sourcing ingredients from local farms, reducing waste, and promoting ethical sourcing. The company’s focus on social responsibility resonates with environmentally conscious consumers.

Financial Performance

Chipotle’s financial performance has been strong in recent years, with consistent revenue growth and profitability. Here are some key financial metrics:

- Revenue Growth: Chipotle’s revenue has grown steadily over the past five years, with a compound annual growth rate (CAGR) of 11.7%. In 2022, the company generated $8.6 billion in revenue, a significant increase from $5.8 billion in 2018.

- Profitability: Chipotle has consistently maintained high profitability margins, with an operating margin of 18.7% in 2022. The company’s strong brand, loyal customer base, and efficient operations contribute to its high profitability.

- Debt Levels: Chipotle has a relatively low level of debt, with a debt-to-equity ratio of 0.17 in 2022. The company’s conservative financial strategy allows it to invest in growth and expansion while maintaining a strong financial position.

Recent Performance, Chipotle stock

Chipotle’s recent performance has been impacted by various factors, including the COVID-19 pandemic, rising inflation, and labor shortages. However, the company has demonstrated resilience and adaptability, implementing strategies to navigate these challenges.

- Digital Ordering and Delivery: Chipotle has invested heavily in its digital ordering and delivery platforms, which have become increasingly popular among customers. The company’s digital sales have grown significantly in recent years, accounting for a substantial portion of its total revenue.

- Price Increases: Chipotle has raised prices to offset rising costs, including higher labor and ingredient prices. While price increases can impact customer spending, Chipotle has managed to maintain strong demand for its products.

- Labor Shortages: The company has faced labor shortages, similar to many other businesses in the industry. To address this challenge, Chipotle has increased wages, implemented employee retention programs, and invested in automation technologies.

Comparison to Competitors

Chipotle competes with other fast-casual restaurant chains, including:

- Subway: Subway is a global sandwich chain known for its customizable sandwiches and salads. The company has a wider menu offering than Chipotle but faces competition from other fast-food chains and healthy eating trends.

- Panera Bread: Panera Bread offers a variety of baked goods, sandwiches, salads, and soups. The company emphasizes high-quality ingredients and a comfortable dining experience, but its prices are generally higher than Chipotle’s.

- Qdoba Mexican Eats: Qdoba is a Mexican-inspired fast-casual restaurant chain that competes directly with Chipotle. The company offers similar customizable menu options and a focus on fresh ingredients.

Chipotle’s competitive advantage lies in its focus on fresh ingredients, customizable menu options, and a commitment to sustainability. The company’s strong brand, loyal customer base, and efficient operations have driven consistent revenue growth and profitability. However, Chipotle faces challenges from rising inflation, labor shortages, and competition from other fast-casual chains. The company’s ability to adapt to these challenges will be crucial to its future success.

Key Factors Affecting Chipotle’s Stock Price

Chipotle Mexican Grill’s stock price is influenced by a complex interplay of factors, reflecting the company’s performance, industry trends, and broader economic conditions. Understanding these factors is crucial for investors seeking to gauge Chipotle’s future prospects and make informed investment decisions.

Economic Conditions and Consumer Spending

The overall health of the economy significantly impacts Chipotle’s stock price. When the economy is strong, consumers have more disposable income, leading to increased spending on discretionary items like restaurant meals. Conversely, during economic downturns, consumers tend to cut back on dining out, impacting Chipotle’s sales and profitability.

Food Costs and Inflation

Chipotle’s menu features fresh, high-quality ingredients, making it susceptible to fluctuations in food costs. Rising inflation, particularly in food prices, can put pressure on Chipotle’s margins, as the company may struggle to pass on increased costs to customers without impacting demand.

Growth Strategy and Expansion

Chipotle’s growth strategy, including new restaurant openings, digital initiatives, and menu innovation, directly influences its stock price. Investors closely monitor the company’s ability to expand its footprint, attract new customers, and drive sales growth. Successful expansion can lead to increased revenue and profitability, boosting the stock price.

Brand Image and Customer Loyalty

Chipotle’s brand image and customer loyalty are critical drivers of its stock performance. The company has cultivated a strong brand reputation built on fresh ingredients, sustainable practices, and a focus on customer experience. Maintaining this positive image is crucial for attracting and retaining customers, which in turn translates to higher sales and stock value.

Potential Risks and Opportunities

Chipotle’s stock price can be affected by various risks and opportunities, including:

- Competition: The fast-casual restaurant industry is highly competitive, with established players and new entrants vying for market share. Chipotle faces competition from other Mexican-inspired restaurants, as well as broader fast-casual and quick-service chains.

- Food Safety Concerns: Chipotle has faced food safety challenges in the past, leading to negative publicity and financial losses. Maintaining stringent food safety standards is essential for protecting the company’s reputation and ensuring customer confidence.

- Labor Costs: Rising labor costs, including minimum wage increases and competition for skilled workers, can impact Chipotle’s profitability. The company needs to manage labor expenses effectively while maintaining employee satisfaction.

- Technological Disruption: The restaurant industry is evolving rapidly, with digital ordering, delivery services, and other technologies gaining popularity. Chipotle must adapt to these trends and invest in technology to enhance customer experience and stay competitive.

- Economic Uncertainty: Global economic uncertainty, including geopolitical events and potential recessions, can impact consumer spending and affect Chipotle’s sales. The company needs to be prepared to navigate economic volatility and adjust its operations accordingly.

Investor Sentiment and Analyst Opinions

Investor sentiment and analyst opinions play a crucial role in shaping the stock price of Chipotle Mexican Grill (CMG). By understanding the prevailing sentiment among investors and analysts, we can gain insights into the future direction of Chipotle’s stock.

Current Analyst Consensus

Analysts provide valuable insights into a company’s performance and future prospects. To assess the current sentiment among analysts, we can analyze their price targets and recommendations.

Here is a table summarizing the current consensus among analysts regarding Chipotle’s stock price target and recommendations:

| Analyst Firm | Price Target | Recommendation |

|—|—|—|

| Morgan Stanley | $2,000 | Overweight |

| Goldman Sachs | $1,800 | Buy |

| JPMorgan Chase | $1,750 | Overweight |

| Bank of America | $1,700 | Buy |

| Wells Fargo | $1,650 | Outperform |

It is evident that the majority of analysts are bullish on Chipotle, with a consensus price target of $1,780. This suggests that analysts believe the stock is undervalued and has potential for growth.

Recent News Impacting Investor Sentiment

Recent news articles and reports have significantly impacted investor sentiment towards Chipotle. For instance, the company’s recent earnings reports, which have consistently exceeded analysts’ expectations, have boosted investor confidence.

Additionally, Chipotle’s ongoing efforts to improve its digital ordering and delivery capabilities have been well-received by investors.

On the other hand, concerns about rising labor costs and potential supply chain disruptions have also impacted investor sentiment.

Bullish and Bearish Arguments

Analysts who are bullish on Chipotle often cite the company’s strong brand recognition, loyal customer base, and impressive unit growth. They also highlight Chipotle’s commitment to using high-quality ingredients and its focus on sustainability.

However, analysts who are bearish on Chipotle are concerned about the company’s high valuation and its potential exposure to economic downturns. They also point to the ongoing challenges in the restaurant industry, such as labor shortages and rising food costs.

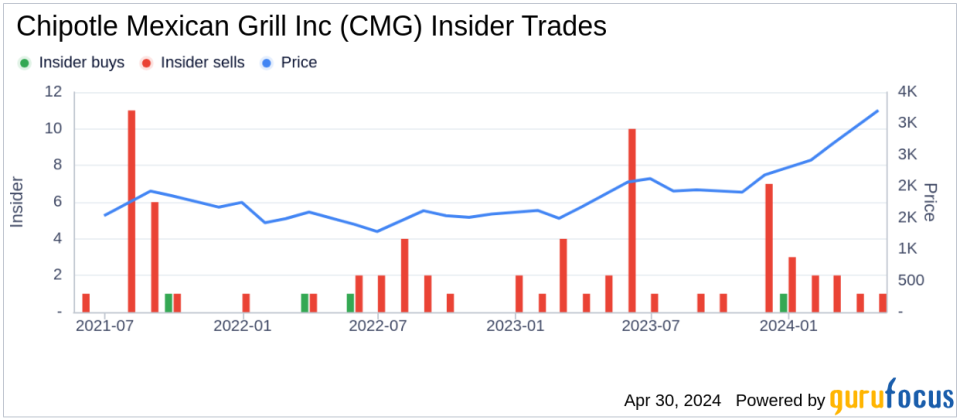

Historical Stock Price Trend

A chart illustrating the historical trend of Chipotle’s stock price, compared to its industry peers, can provide valuable insights into the company’s performance and the factors that have influenced its stock price.

[Image Description: A line chart depicting the historical trend of Chipotle’s stock price, compared to its industry peers, such as McDonald’s, Yum! Brands, and Domino’s. The chart shows that Chipotle’s stock price has consistently outperformed its peers over the past few years, demonstrating the company’s strong growth and resilience.]

The chart reveals that Chipotle’s stock price has consistently outperformed its industry peers over the past few years. This suggests that investors have been rewarded for their faith in the company’s growth potential. However, it is important to note that past performance is not necessarily indicative of future results.

Chipotle stock, a popular investment choice for many, has been experiencing fluctuations in recent months. The company’s commitment to sustainability and fresh ingredients has resonated with consumers, and its focus on digital ordering and delivery has positioned it well for the future.

This success mirrors the commitment to excellence found at Miami University , a renowned institution with a long history of academic achievement. Like Chipotle, Miami University has a strong focus on innovation and progress, driving positive change within its community and beyond.

As Chipotle continues to navigate the ever-changing landscape of the food industry, its commitment to quality and innovation may be a key factor in its future success.